KOF’s economic forecast, spring 2022: Swiss economy holds up well despite war in Ukraine

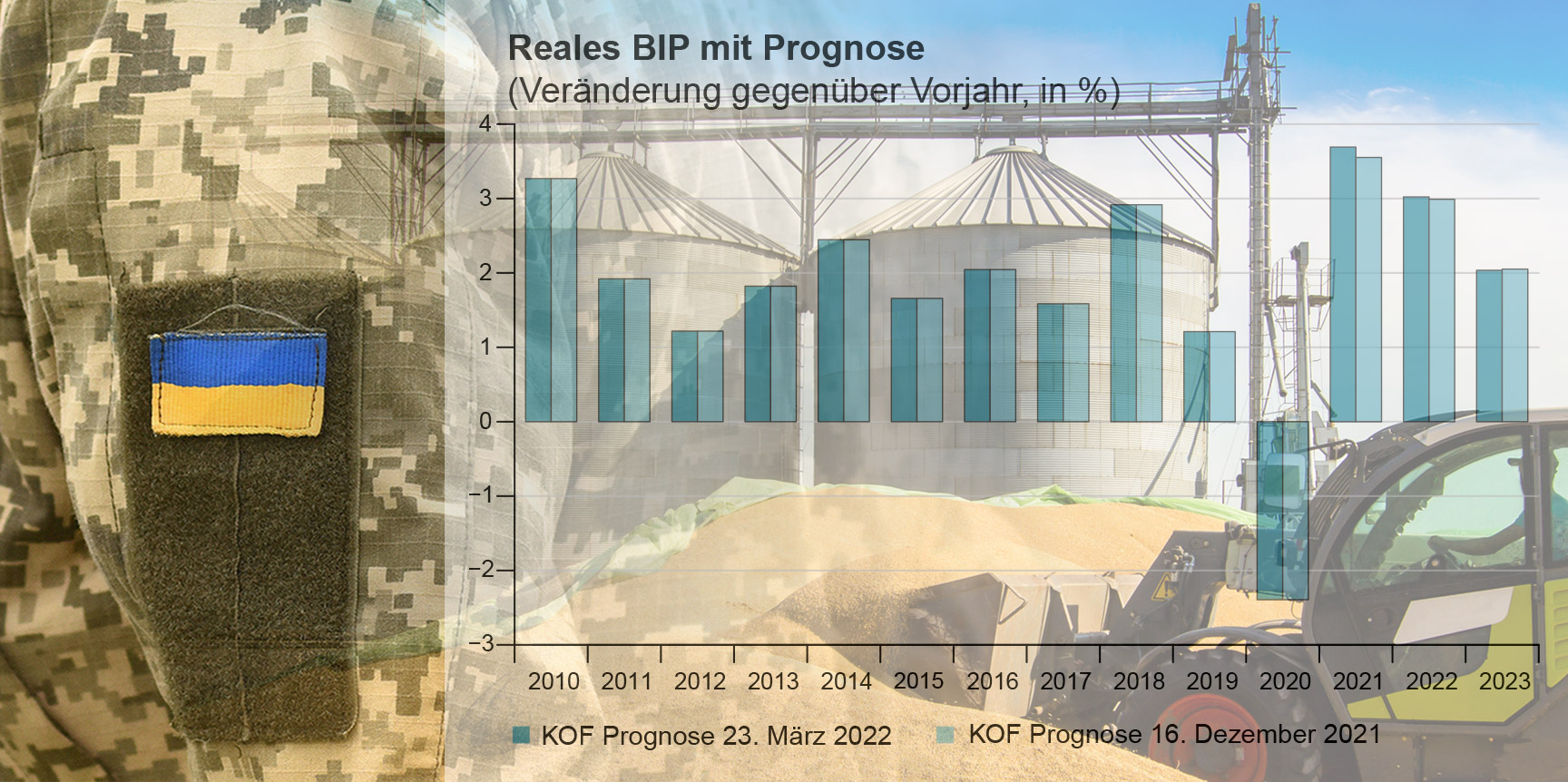

According to KOF’s economic forecast, the Swiss economy will grow by just under 3 per cent this year – but only in the favourable scenario. If the Ukraine crisis spreads and all Russian energy and commodity exports to the EU and other regions are discontinued, the Russian trade in oil is withdrawn from Switzerland and the Swiss franc appreciates significantly, GDP growth of only 1 per cent would remain in 2022.

Global economy in crisis mode; COVID-19 recovery dampened by war in Ukraine

The invasion of Ukraine by Russian troops on 24 February and the resulting economic sanctions imposed on Russia have plunged the global economy back into crisis. The economic recovery in the wake of the easing or lifting of the restrictions imposed to contain the spread of coronavirus in many places is thus being hampered by new negative shocks. In the short term, the economy is feeling the effects of this war in the form of a sharp rise in energy and commodity prices. This trend is exacerbating the price increases already observed in many places. Trade with Russia has come to a virtual standstill in all areas except energy. As many companies active in international commodity trading are based in Switzerland, further and more comprehensive embargos than those already in place could cause a significant loss of value added. And, finally, the uncertainty arising from the threat of any further escalation – including military action against other countries in the region – could have a negative impact on the propensity to consume and invest. Even if a ceasefire between Ukraine and Russia is agreed fairly soon, this war has permanently changed the geopolitical situation and, consequently, the global economy.

Favourable scenario: GDP growth of 2.9 per cent

Had it not been for Russia’s invasion of Ukraine (a counterfactual scenario – see box below), growth in gross domestic product (GDP) adjusted for sporting events would probably have been close to 3.2 per cent this year (3.3 per cent including sporting events). Compared with this counterfactual (fictitious) growth rate, which would be primarily driven by the recovery following the lifting of pandemic restrictions, KOF now puts GDP growth in the favourable scenario at 2.9 per cent (3.0 per cent including sporting events). In this scenario, the economic impact that the war has on the global economy is mostly limited to the second quarter of 2022, even though many of the sanctions imposed on Russia will remain in force thereafter. Since neither Russia nor Ukraine are significant trading partners of Switzerland, however, the damage inflicted by any disruption of trade flows is limited in the favourable scenario even if individual companies are severely affected. GDP adjusted for sporting events is expected to increase by 2.3 per cent (2.0 per cent including sporting events) in 2023. Although this rate is significantly lower than that for 2022, it is still above the potential growth rate. As the catch-up effects following the coronavirus pandemic are gradually subsiding, the level of momentum is slowly returning to normal.

Negative scenario: GDP growth of 1 per cent

KOF’s negative scenario assumes that all Russian energy and commodity exports, including those to the EU, are halted. Energy prices would continue to surge and production restrictions would increasingly be imposed in some European countries. Foreign demand for Swiss products would decrease. It is also assumed that trade in Russian commodities in Switzerland would be discontinued. Furthermore, KOF expects the Swiss franc to appreciate rapidly and sharply in this negative scenario. Given these assumptions, the GDP growth rate adjusted for sporting events would be only 1 per cent in 2022 (1.1 per cent including sporting events). This would be around 2 percentage points lower than in the favourable scenario. In 2023, GDP would increase by 0.8 per cent (0.5 per cent including sporting events), which is still around 1.5 percentage points lower than in the favourable scenario.

Unemployment is expected to rise in the negative scenario

The most striking difference between the negative scenario and the favourable scenario can be seen in the second quarter of 2022. Whereas a moderate but still positive growth rate is being forecast in the favourable scenario, it is expected to fall to around minus 6 per cent on an annualised basis in the negative scenario. This would not, however, lead to a recession in the technical sense (defined as two successive quarters of negative growth) as GDP growth in the third quarter will be slightly positive owing to a modest rebound effect. Nonetheless, overall economic capacity would remain heavily underutilised in the third quarter. In this negative scenario the labour market would also come under pressure. In severely affected sectors, such as parts of manufacturing industry, there would be job losses lasting several quarters.

Inflation in Switzerland remains moderate

The current rise in inflation domestically and internationally has undergone a qualitative change as a result of the Ukraine crisis. The war has ensured that inflation is likely to rise more sharply and not decline quite as quickly as previously assumed. There are initial signs that long-term inflation expectations in Switzerland may have already increased. In contrast to other parts of Europe and the United States, however, where inflation is already tending towards double digits, inflation in Switzerland remains moderate. Although Swiss consumer prices in the favourable scenario will rise by 1.9 per cent in 2022, this increase will fall to 0.7 per cent in 2023. Inflation of 2.8 per cent (2022) and 1.2 per cent (2023) in the negative scenario will temporarily exceed the range of up to 2 per cent that the Swiss National Bank (SNB) defines as price stability.

Dangerous virus variants remain a forecasting risk

KOF assumes for all scenarios that no contact restrictions will be reintroduced. The endemic scenario applied to Switzerland assumes that COVID-19 infections will form part of everyday life and will place very few constraints on the activities of healthy individuals. However, the assumed endemic scenario could in retrospect prove to be over-optimistic given that the pandemic is likely to be far from over, which poses the risk that new and dangerous variants of the virus could emerge and, furthermore, it is not yet clear how long the Swiss population’s current immunity to the variants now circulating will last.

The scenarios

KOF is presenting two scenarios in its spring forecast to reflect the huge political uncertainty arising from the war in Ukraine. KOF considers the favourable scenario to be favourable because it assumes that the military action will end soon and that the negative impact on the economy will be fairly short term in nature. This is contrasted with a negative scenario, which assumes that the war will escalate further and the fighting will continue for longer, with the West imposing even tougher sanctions on Russia and Russia responding by imposing sanctions on the West. This negative scenario would see all Russian exports of energy and commodities to the European Union (EU) being discontinued, which would cause severe shortages of energy and intermediate products, thereby disrupting production and necessitating rationing. The European economy would then slide into recession and the Swiss economy would suffer a sharp decline in output in the second quarter of this year. The counterfactual scenario, on the other hand, is purely fictitious and therefore not a scenario in the strict sense. It calculates how Swiss GDP would have performed had it not been for the war in Ukraine.

Contact Swiss Economy

KOF FB Konjunktur

Leonhardstrasse 21

8092

Zürich

Switzerland

Contact International Business Cycle

Director of KOF Swiss Economic Institute

Professur f. Wirtschaftsforschung

Leonhardstrasse 21

8092

Zürich

Switzerland